Key Inclusions

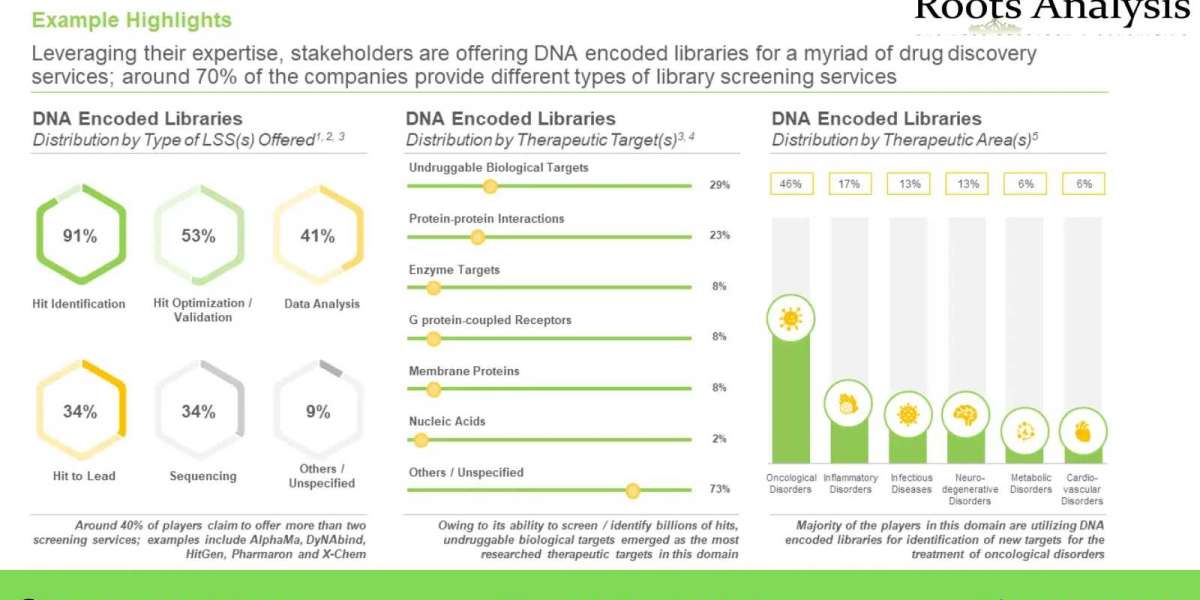

- A detailed assessment of the overall landscape of DNA encoded library service providers / platform providers / in-house companies, based on various relevant parameters, such as year of establishment, company size (in terms of employee count), location of headquarters, type of organization (academic / research institute, biopharmaceutical, contract development and manufacturing organization (CDMO), contract manufacturing organization (CMO) and contract research organization (CRO)), library size (1 billion, 1-10 billion and 10 billion), library synthesis method(s) (DNA-conjugate, self-assembled, DNA-directed and unspecified library synthesis method), library screening method(s) (conventional screening, Artificial Intelligence (AI) / Machine Learning (ML)-based screening and unspecified screening method), type of product(s) offered (proprietary library, DEL synthesis package / kit and ancillary tools), type of service(s) offered (type of library design service(s) offered - codon (oligo) sequence design and synthesis and custom library design / synthesis, and type of library screening service(s) offered - hit identification, hit optimization / validation, hit to lead, sequencing, data analysis and other / unspecified services offered), type of pharmacological lead(s) (small molecules, macrocycles / peptides and other / unspecified molecules), therapeutic target(s) (G protein-coupled receptors, protein-protein interactions, enzyme targets, membrane proteins, nucleic acids, undruggable biological targets and other / unspecified therapeutic target), therapeutic area(s) (oncological disorders, cardiovascular disorders, neurodegenerative disorders, inflammatory disorders, metabolic disorders, infectious diseases, ophthalmic disorders and other / unspecified therapeutic areas) and end-user(s) (academic / research institute and pharma / biopharma industry).

- A detailed analysis of various business models adopted by the companies providing DNA encoded library platforms and services, include operational model, service centric model and product centric model.

- A detailed competitiveness analysis of DNA encoded libraries platform and service providers based on supplier strength (in terms of year of establishment and company size) and company competitiveness (in terms of type of business model, number of products offered, number of services offered, number of platforms, number of pharmacological leads, number of therapeutic area and number of therapeutic target).

- Elaborate profiles of the prominent platform and service providers (shortlisted based on a proprietary criterion) engaged in this market. Each profile features a brief overview of the company (including information on its year of establishment, number of employees, location of headquarters and key members of the executive team), DNA encoded library platform and service portfolio, recent developments and an informed future outlook.

- A detailed analysis of the partnerships inked between industry / non-industry stakeholders engaged in this industry, since 2010, covering research agreements, RD agreements, license agreements (specific to technology platforms and product candidates), product development agreements, product development and commercialization agreements, mergers and acquisitions and other relevant agreements.

- An analysis of funding and investments that have been made into companies having proprietary DNA encoded chemical library, including venture capital financing, capital raised from IPOs and subsequent offerings, grants, and debt financing. It includes a detailed analysis of the funding instances that have taken place during the period 2018 to 2023, highlighting the growing interest of venture capital (VC) community and other strategic investors in this market.

- An in-depth analysis of various patents that have been filed / granted related to DNA encoded chemical library, since 2005, taking into consideration several parameters, such as publication year, application year, patent jurisdiction, CPC symbols, leading players (in terms of number of patents filled / granted) and type of organization. In addition, the chapter includes a detailed patent benchmarking and an insightful patent valuation analysis, highlighting the leading patents (in terms of number of citations).

- A detailed analysis of various DNA encoded libraries focused initiatives undertaken by big pharma players (shortlisted on the basis of the revenues generated in 2022), featuring heat map representations that highlight the distribution of top pharmaceutical companies and spider web representations, comparing the initiatives of big pharma players based on multiple relevant parameters.

- A case study on companies / organizations that are presently engaged in supporting the development of DNA encoded libraries. Further, chapter also includes analysis based on various relevant parameters, such as year of establishment, company size (in terms of employee count), location of headquarters (North America, Europe and Asia-Pacific), type of organization (pharma / biopharma industry and academic / research institutes) and types of support services / ancillary tools offered (building blocks, oligos, scaffolds and other support services / ancillary tools).

- An insightful market forecast analysis, highlighting the future potential of the DNA encoded library market, till 2035. We have segregated the current and upcoming opportunity based on relevant parameters, such as application areas (hit generation / identification, hit to lead, hit validation / optimization and other application areas), therapeutic area (oncological disorders, immunological disorders, neurological disorders, respiratory disorders, dermatological disorders, cardiovascular disorders, infectious diseases and other therapeutic areas), end-users (pharma / biopharma industry, academic / research institute and other end-users), type of payment model employed (upfront payment and milestone payment) and key geographical regions (North America - US, Europe - UK, Germany, Denmark, France, Switzerland and Rest of the Europe, and Asia-Pacific - China).

The financial opportunity within the DNA encoded library market has been analyzed across the following segments:

- Application Area

- Hit Generation / Identification

- Hit to Lead

- Hit Validation / Optimization

- Other Application Areas

- Therapeutic Area

- Oncological Disorders

- Immunological Disorders

- Neurological Disorders

- Respiratory Disorders

- Dermatological Disorders

- Cardiovascular Disorders

- Infectious Diseases

- Other Therapeutic Areas

- End-user

- Pharma / Biopharma Industry

- Academic / Research Institute

- Other End-users

- Type of Payment Model Employed

- Upfront Payment

- Milestone Payment

- Key Geographical Regions

- North America

- Europe

- Asia-Pacific

The report features inputs from eminent industry stakeholders, according to whom, DNA encoded libraries are likely to witness enhanced adoption given their advantages of optimizing drug discovery and demonstrating greater selectivity of hit molecules for chemical targets, thereby, offering lucrative opportunities to their developers.

The research also includes detailed profiles of key players (listed below) offering DNA encoded library platforms and services; each profile features a brief overview of the company, its financial information (if available), details on platform and service portfolio, recent developments and an informed future outlook.

- AlphaMa

- DICE Therapeutics

- DyNAbind

- HitGen

- NovAliX

- Vipergen

- WuXi AppTec

- X-Chem

Key Questions Answered

- What is a DNA encoded library?

- What is DNA encoded library screening?

- How are DNA encoded libraries made?

- How is information encoded in DNA?

- How DNA encoded libraries are revolutionizing drug discovery?

- What are the advantages of DNA encoded library?

- How many companies are developing DNA encoded libraries?

- Which type of business model is widely adopted by companies in DNA encoded library market?

- What is the current landscape of patents filed for DNA encoded libraries?

- Who are the key players in the DNA encoded library market?

- What are the leading market segments in the global DNA encoded library market?

- Which region captures the largest share in the DNA encoded library market?

- What is the likely growth rate (CAGR) for DNA encoded library market?

To view more details on this report, click on the link:

https://www.rootsanalysis.com/reports/view_document/dna-encoded-libraries/288.html

Learn from experts: do you know about these emerging industry trends?

Antiviral Drugs: The Unmet Requirement in the Pharmaceutical Space

Key Trends in Non-Viral Transfection Market

Learn from our recently published whitepaper: -

Next Generation Biomanufacturing – The Upcoming Era of Digital Transformation

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Learn more about Roots Analysis consulting services:

Roots Analysis Consulting - the preferred research partner for global firms

Contact:

Ben Johnson

+1 (415) 800 3415